Who Needs to File

- Reporting companies created or registered to do business in the United States before January 1, 2024 must file by January 1, 2025.

- Reporting companies created or registered to do business in the United States in 2024 have 90 calendar days to file after receiving actual or public notice that their company’s creation or registration is effective

Why It Matters

- Non-compliance can result in penalties of $591 per day for each day a company is in violation of the rule.

Where To File

- You can file your BOI report online directly with the Federal Government at FinCEN’s BOI E-Filing Portal HERE or go to https://boiefiling.fincen.gov/

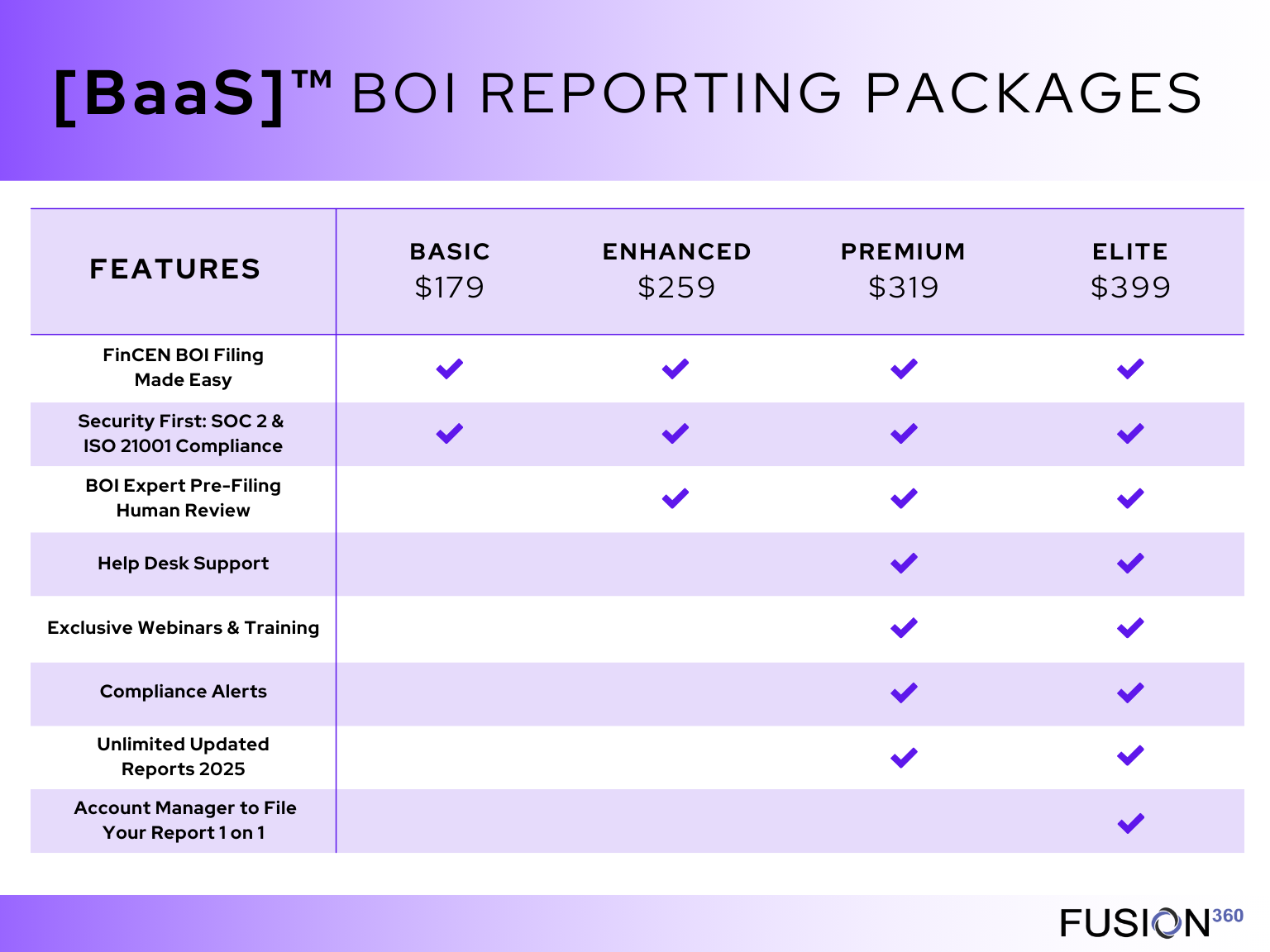

- You can get assistance with your BOI Reporting from FUSION360. FUSION360 offers a streamlined, secure, and easy-to-use platform known as [BaaS]™ for filing your BOI report. Their team of BOI experts provides various levels of assistance tailored to your specific needs, ensuring a smooth and secure filing process. Pricing varies based on the service level:

- Basic: $179 - A simplified and secure portal to file your report directly with FinCEN

- Enhanced: $259 - Includes expert human review prior to filing

- Premium Service: $319 - Adds help desk support, webinars, and compliance alerts

- Elite Service: $399 - Adds a dedicated report manager to do your filing with you one-on-one.

- Premium & Elite service levels also include free updated reports through 2026. Although this is a one time filing and NOT an annual report, you do need to submit any changes to your Beneficial Ownership Information Report within 30 days.

To Learn More

- You can go directly to the [BaaS]™ platform by clicking HERE

- You can contact FUSION360 by emailing [email protected] or get live assistance at www.boi-fincen.com